By Lee Egerstrom

Native Americans are not immune to scams that are ripping off billions of dollars every year, but there are tools and people who can help them stop these attacks in Indian Country. They can even help retrieve stolen money in some cases.

That is the message the Federal Trade Commission (FTC) is bringing to various communities within the United States, including the Native American and Alaskan Native communities, as part of a special outreach program.

Outreach reached Minnesota in November. FTC officials made a presentation to the Minnesota Indian Affairs Council and in a news briefing, or webinar, for Native news media.

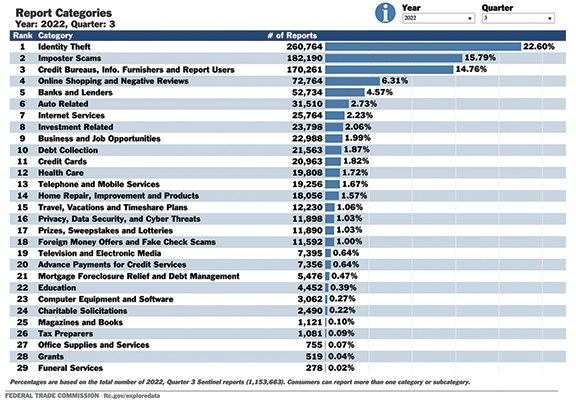

Joannie Wei, assistant director of FTC’s Midwest Region office in Chicago, told tribal leaders and visitors to the MIAC meeting on Nov. 16 that year to date records show Minnesota had 22,723 reported frauds, identify thefts and similar scams.

Of them, 12,833 were fraud reports that totaled $32.8 million in losses to people and businesses. The median loss was $643.

In the presentation to the media on Nov. 10, Monica Vaca, FTC’s associate director of the Bureau of Consumer Protection, said scammers ripped off $6.1 billion from people last year in 2.9 million reported cases across the country.

It is also feared, FTC officials said, that a majority of scams do not get reported.

Imposter scams, where people pretend to be someone other than themselves, accounted for $2.4 billion of the losses reported last year.

In the presentation to Native media, Vaca, Wei and a Flagstaff, Ariz., legal services lawyer, Michael Elliott, introduced a Navajo woman who was bamboozled by an auto dealership firm operating off but close to the Navajo Nation.

The legal services office got the Arizona Attorney General’s office involved. That pressure got the Navajo woman’s financial problem resolved. The Navajo Human Rights Commission also reached out and got FTC involved. That led to FTC getting $415,000 returned to 3,500 people victimized by the auto dealers.

Scams take many forms, Wei told Minnesota tribal leaders.

Of Minnesota’s known cases, imposter scams and identity theft account for three-fourths of our scams. Online shopping and negative review scams, problems with banks and lenders, and problems with credit bureaus, information furnishers and their report users are other major categories.

Other reoccurring scams involved supposed prizes, sweepstakes and lotteries; auto related problems, health care, debt collection and supposed internet services.

Wei said she would like to work an informal partnership with Native tribal groups and organizations in Minnesota that could be helpful in information sharing.

“This could involve webinars, training on particular topics, participating in community events, or sharing of resources,” she told The Circle. “We also want to listen to the communities and hear about the issues they are facing,” as was the case with the Navajo.

The FTC officials stress that anyone seeking money from you and wanting payment made in gift cards, credit cards or money transfers is almost always a scammer. Scammers will also insist there is an emergency requirement that you do it now.

“If you realize you’ve been scammed and you paid by check, wire transfer, or credit card, contact your bank or credit card company right away and try to stop the transaction,” said FTC attorney Matthew Schiltz.

Then, he said, report what happened to the FTC on their website at: www.reportfraud.ftc.gov.

Schiltz said someone who files a fraud report with the FTC will then receive guidance about the particular type of scam that they reported, and there is helpful general information about avoiding scams and recovering from fraud on the site.

Report it to the FTC “reportfraud” website even if you didn’t get to the point of making a payment but think you might have run across a scam or an unfair business practice, he said.

Schiltz also reminds Minnesotans they can also file consumer complaints and request assistance from the Office of the Minnesota Attorney General on their website at: www.ag.state.mn.us/Office/Complaint.asp.

The Attorney General’s Office notes on the site that these reports help it and law enforcement agencies identify potential violations of Minnesota law, identify new problems in the marketplace, build lawsuits against companies (and individuals) who violate state laws, and educate the public about emerging scams.

“If you have experienced a consumer problem that doesn’t seem right, we would like to hear about it. Even if we have already started a lawsuit, information from consumers may provide important evidence for our case,” the site explains.

Elders are particular targets of scammers. Long held landline telephone numbers create a profile for many while younger people are more inclined to use cell phones. This is definitely the case in many Native communities.

Wei said FTC has a special site (www.ftc.gov/PassItOn) to help get helpful information to senior citizens. It has information on identity theft, unwanted calls, health care scams, the so-called “money mule” scams seeking help in transporting money, “You’ve won” scams, home repair scams and charity fraud.

A large part of scams directed at Native elders is the same as the largest category of scams for all Minnesotans – imposter scams.

These include various tech support scams, IRS imposter scams, online dating scams, and grandkid scams.

The FTC has an additional site with extensive information for consumers at: https://consumer.gov.

One of its information categories is called Scams and Identity Theft. It has more information on imposter scams, avoiding identity theft, recovering from identity theft, scams against immigrants and job scams.

It clearly explains imposter scammers who either pretend to be someone you know, or to be representing a company or government agency that may seem credible. Among individuals, the imposter could pretend to be a family member, a friend, or a person you feel like you know but have not met in person, the FTC said.

Further, imposters may pretend to be working for the government, such as the Internal Revenue Service. Imposters working overtime in Minnesota at year’s end pretend to be from a company you trust, such as claiming to be from “your local utility company” without naming it, and healthcare pitches that sometimes pretend to be from Medicare.

Other such imposter schemes come from a company that can fix an oftentimes hacked computer system, a company that is supposedly giving out prizes, and scammers pretending to be a charity seeking donations.

A report on the Native American media briefing and details on the auto fraud at the Navajo Nation can be found at https://ethnicmediaservices.org/scams/ftc-battles-highway-robbery-in-indian-country.